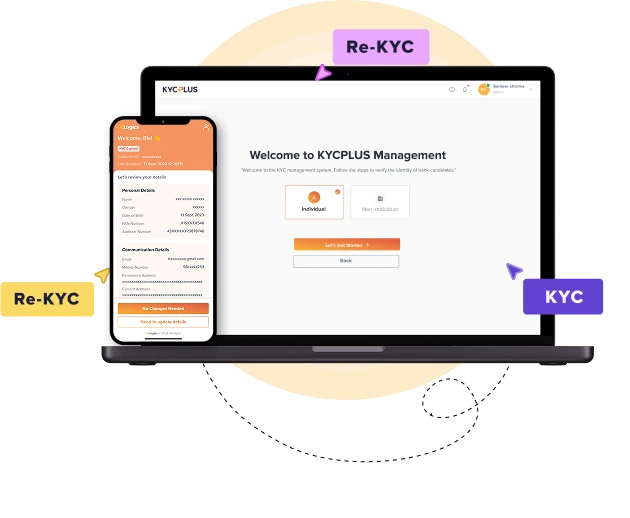

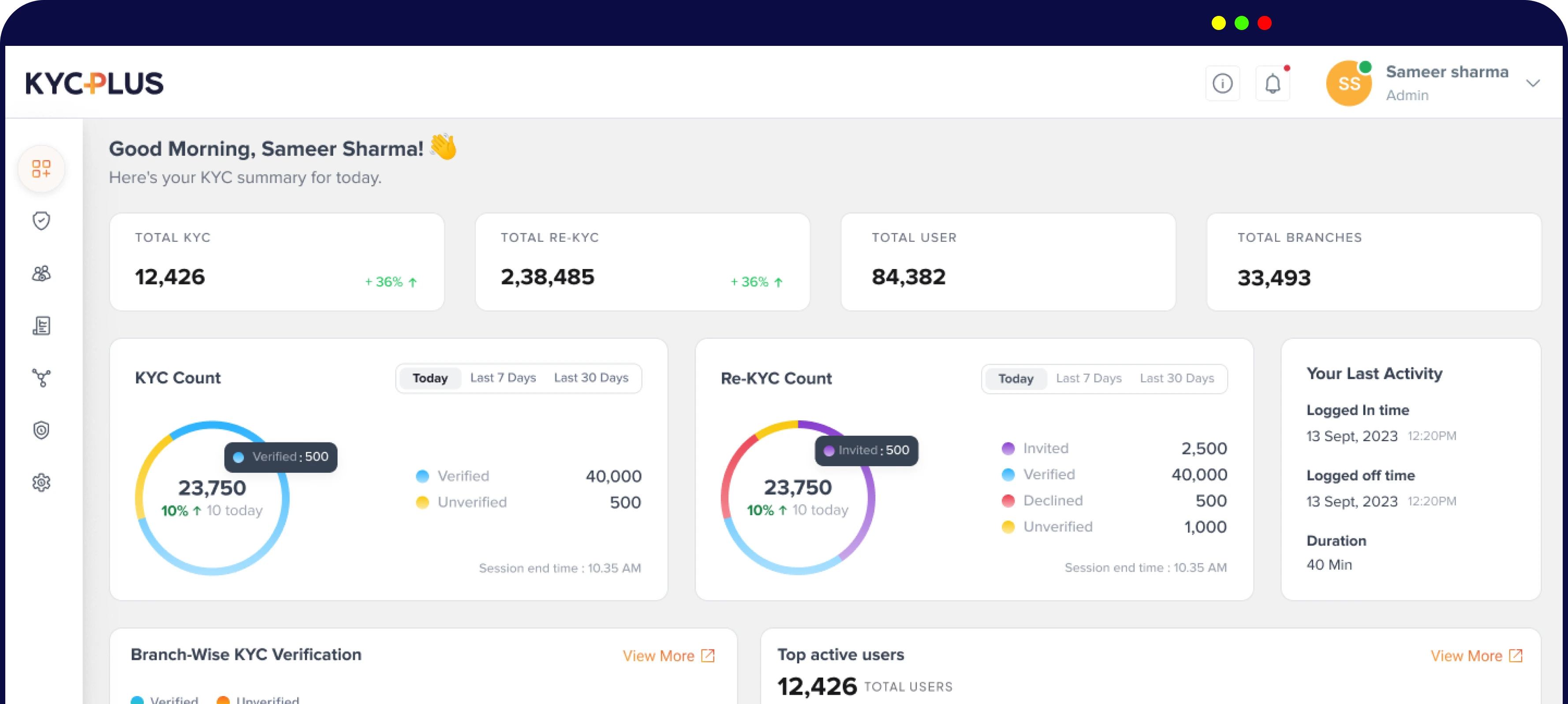

Streamlined, Secure, and Smart KYC Verification for Businesses & Individuals

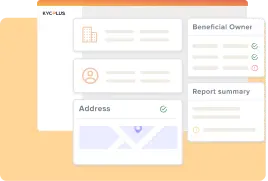

Automated KYC verification solution for KYC, KYB, and Re-KYC.

Designed for real-time validation, seamless compliance, and simplified processes.