KYC

Seamless, Secure, and Compliant KYC Verification

KYC

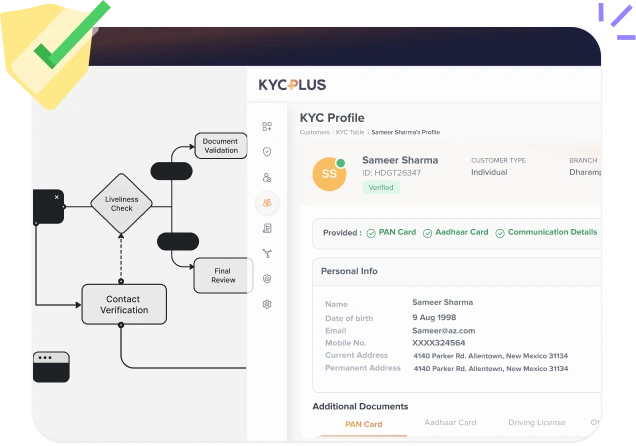

KYCPLUS simplifies KYC with AI-driven verification, ensuring seamless compliance, fraud prevention, and faster customer onboarding.

Leverage AI-driven OCR, Face Match, and Fraud Detection to ensure accurate identity verification and prevent fraudulent activities.

Eliminate paperwork and reduce onboarding time by 80% with a fully digital, automated KYC process.

Stay ahead of RBI, SEBI, and CKYC regulations with automated audits and real- time compliance tracking.

Instantly fetch and verify official documents through DigiLocker, ensuring secure, paperless, and hassle-free KYC compliance.

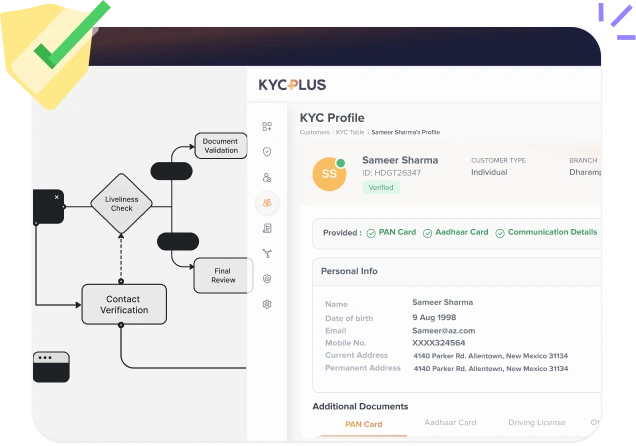

Verify Identity & Address

Authenticate identity and address effortlessly using DigiLocker or by providing official documents like Aadhaar, PAN, Passport, or DL. Our AI-driven verification ensures accuracy, compliance, and fraud prevention while streamlining the onboarding process.

Contact Verification

Confirm registered mobile number and email with a secure OTP-based verification. This step ensures seamless communication, prevents fraudulent entries, and enhances security, creating a trusted digital onboarding experience.

Liveness & Document Validation

Enhance security with a liveness check and facial recognition to verify identity in real time. Upload supporting documents, and our AI-powered system validates them instantly, ensuring compliance and fraud detection.

Final Review & Submission

Before submission, review all provided details for accuracy. Our system ensures data consistency, compliance adherence, and secure storage. Once verified, your KYC is successfully submitted for final approval—quick, hassle-free, and fully compliant.

Our KYC verification service is trusted by diverse industries, delivering secure, compliant, and efficient solutions tailored to your sector's needs.