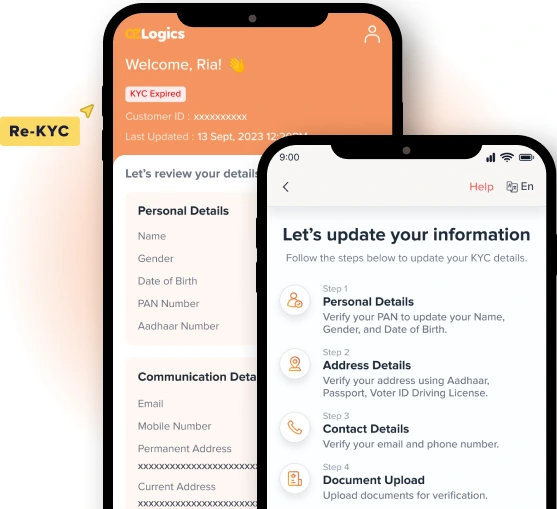

Re-KYC

Automated Re-KYC Solution for Smarter Compliance

Ensure seamless customer record updates with an AI-driven Re-KYC solution. Automate identity verification, reduce manual effort, and stay compliant with evolving regulations—delivering a hassle-free experience for businesses and customers alike.