KYC

KYCPLUS is Your Trusted KYC Solution

KYCPLUS simplifies KYC with AI-driven verification, ensuring seamless compliance, fraud prevention, and faster customer onboarding.

Compliance Without Complexity

KYCPLUS simplifies KYC with AI-driven verification, ensuring seamless compliance, fraud prevention, and faster customer onboarding.

AI & Fraud Prevention

Leverage AI-driven OCR, Face Match, and Fraud Detection to ensure accurate identity verification and prevent fraudulent activities.

Faster Customer Onboarding

Eliminate paperwork and reduce onboarding time by 80% with a fully digital, automated KYC process.

Seamless Compliance

Stay ahead of RBI, SEBI, and CKYC regulations with automated audits and real- time compliance tracking.

DigiLocker Enabled KYC

Instantly fetch and verify official documents through DigiLocker, ensuring secure, paperless, and hassle-free KYC compliance.

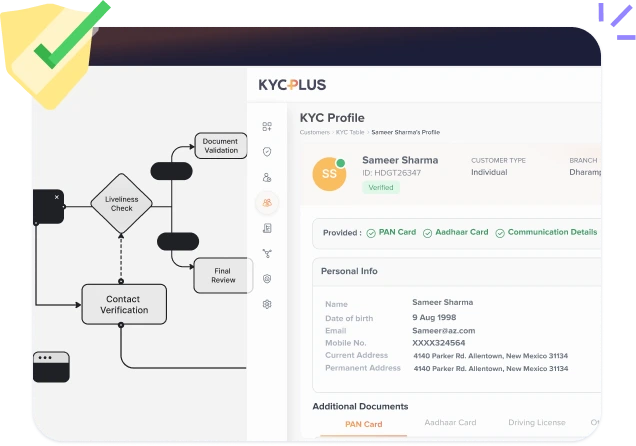

Streamlined KYC Solution for Fast & Secure Verification

Simplify your verification journey with our smart KYC Solution. Seamlessly authenticate identities, upload documents, and complete regulatory checks in just a few steps, ensuring speed, security, and full compliance.

Authenticate identity and address effortlessly using DigiLocker or by providing official documents like Aadhaar, PAN, Passport, or DL. Our AI-driven verification ensures accuracy, compliance, and fraud prevention while streamlining the onboarding process.

Confirm registered mobile number and email with a secure OTP-based verification. This step ensures seamless communication, prevents fraudulent entries, and enhances security, creating a trusted digital onboarding experience.

Enhance security with a liveness check and facial recognition to verify identity in real time. Upload supporting documents, and our AI-powered system validates them instantly, ensuring compliance and fraud detection.

Before submission, review all provided details for accuracy. Our system ensures data consistency, compliance adherence, and secure storage. Once verified, your KYC is successfully submitted for final approval—quick, hassle-free, and fully compliant.

90% Reduction in Manual Effort – Automation has helped businesses eliminate tedious paperwork and verification bottlenecks.

Tailored KYC Solutions Across Industries

Our KYC verification service is trusted by diverse industries, delivering secure, compliant, and efficient solutions tailored to your sector's needs.