KYB

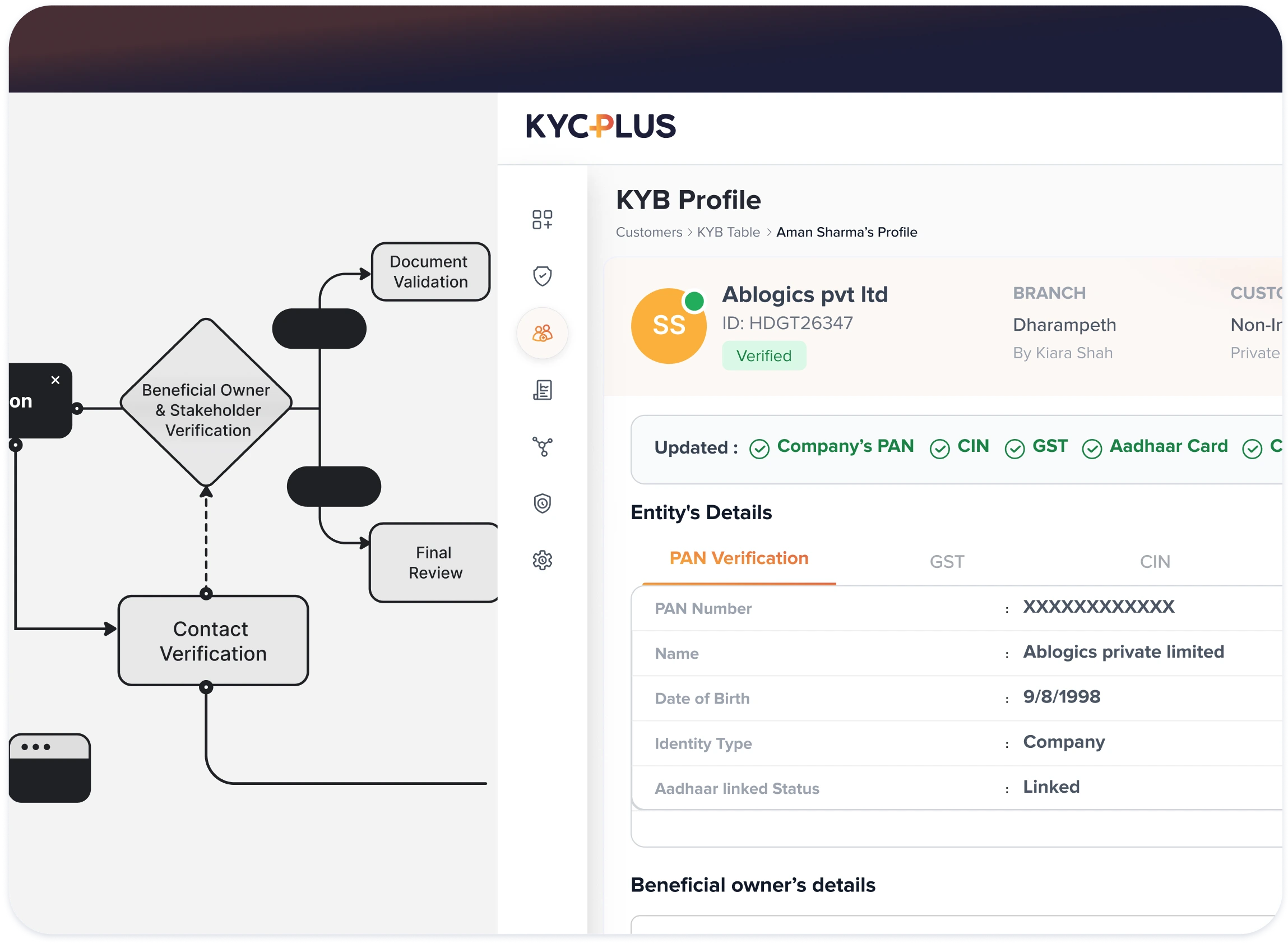

Smart KYB Solution for Secure Growth

Accelerate business onboarding with a KYB Solution that delivers real-time data validation, automated checks, and actionable insights, ensuring secure and compliant partnerships.