KYB

Effortless KYB for Risk-Free Business

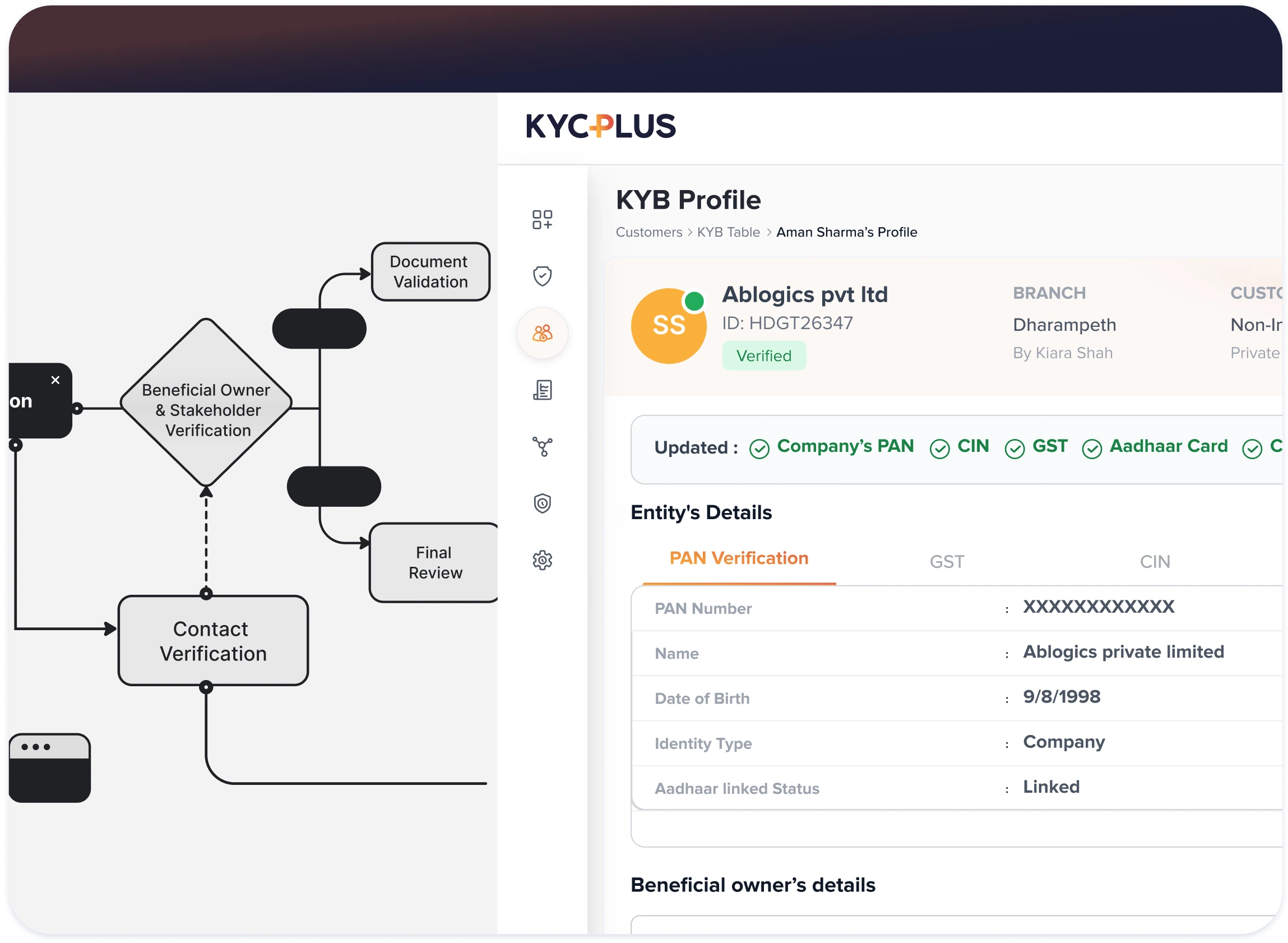

Verify businesses effortlessly with KYCPLUS. Conduct real-time checks on company registration, directors, and Ultimate Beneficial Owners (UBOs) while ensuring regulatory compliance and preventing financial risks.