Redefining Digital Identity Verification with KYCPLUS

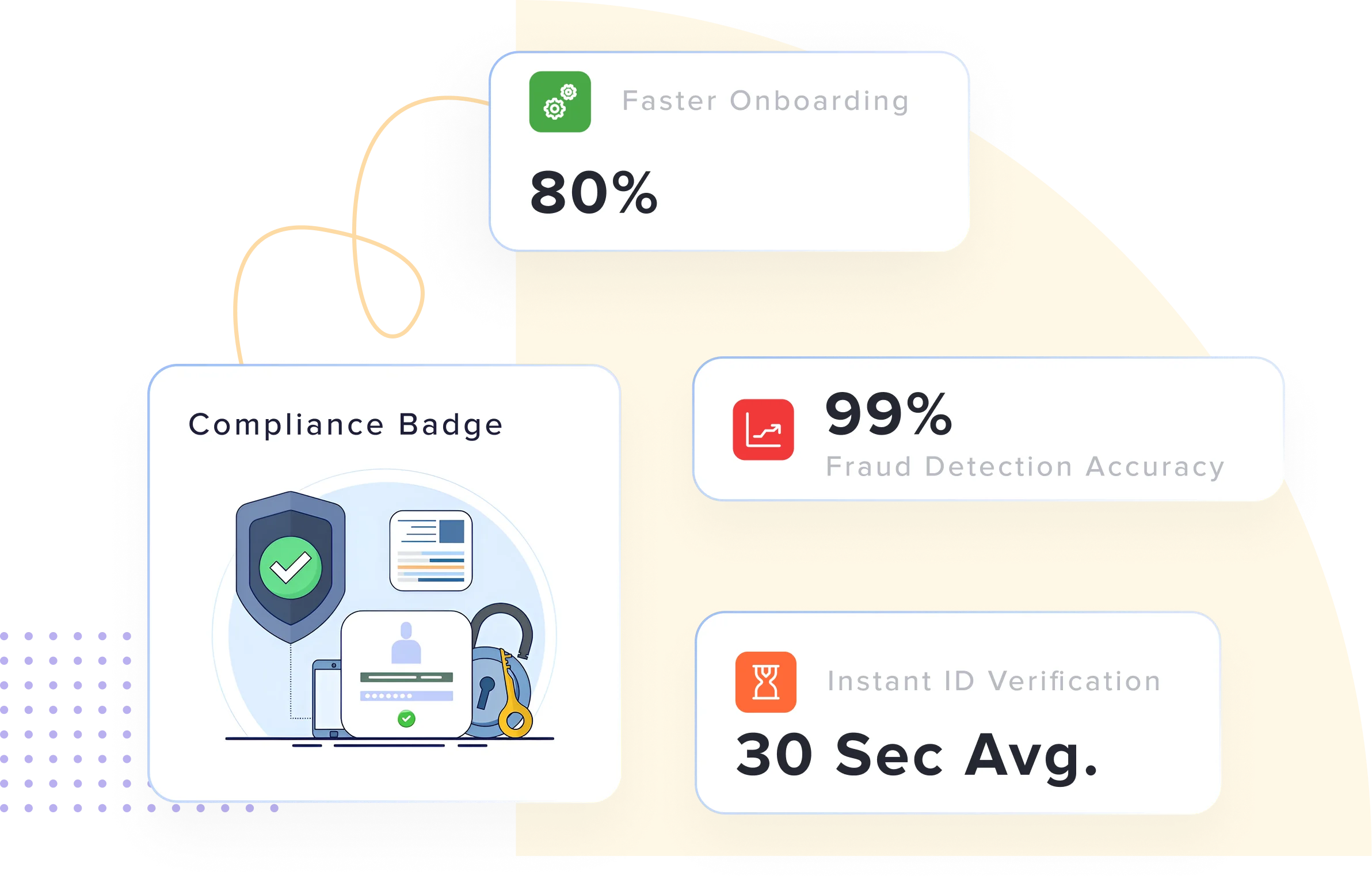

At KYCPLUS, we specialize in delivering streamlined and secure KYC (Know Your Customer) verification solutions, offering businesses and individuals a seamless and efficient process for customer identity validation.