Blog

Online Re-KYC Process for Bank Account: A Complete Guide for Banks & Customers in 2026(And How KYCPLUS Makes It Effortless)

Blog

Online Re-KYC Process for Bank Account: A Complete Guide for Banks & Customers in 2026(And How KYCPLUS Makes It Effortless)

Blog

Online Re-KYC Process for Bank Account: A Complete Guide for Banks & Customers in 2026(And How KYCPLUS Makes It Effortless)

Blog

Online Re-KYC Process for Bank Account: A Complete Guide for Banks & Customers in 2026(And How KYCPLUS Makes It Effortless)

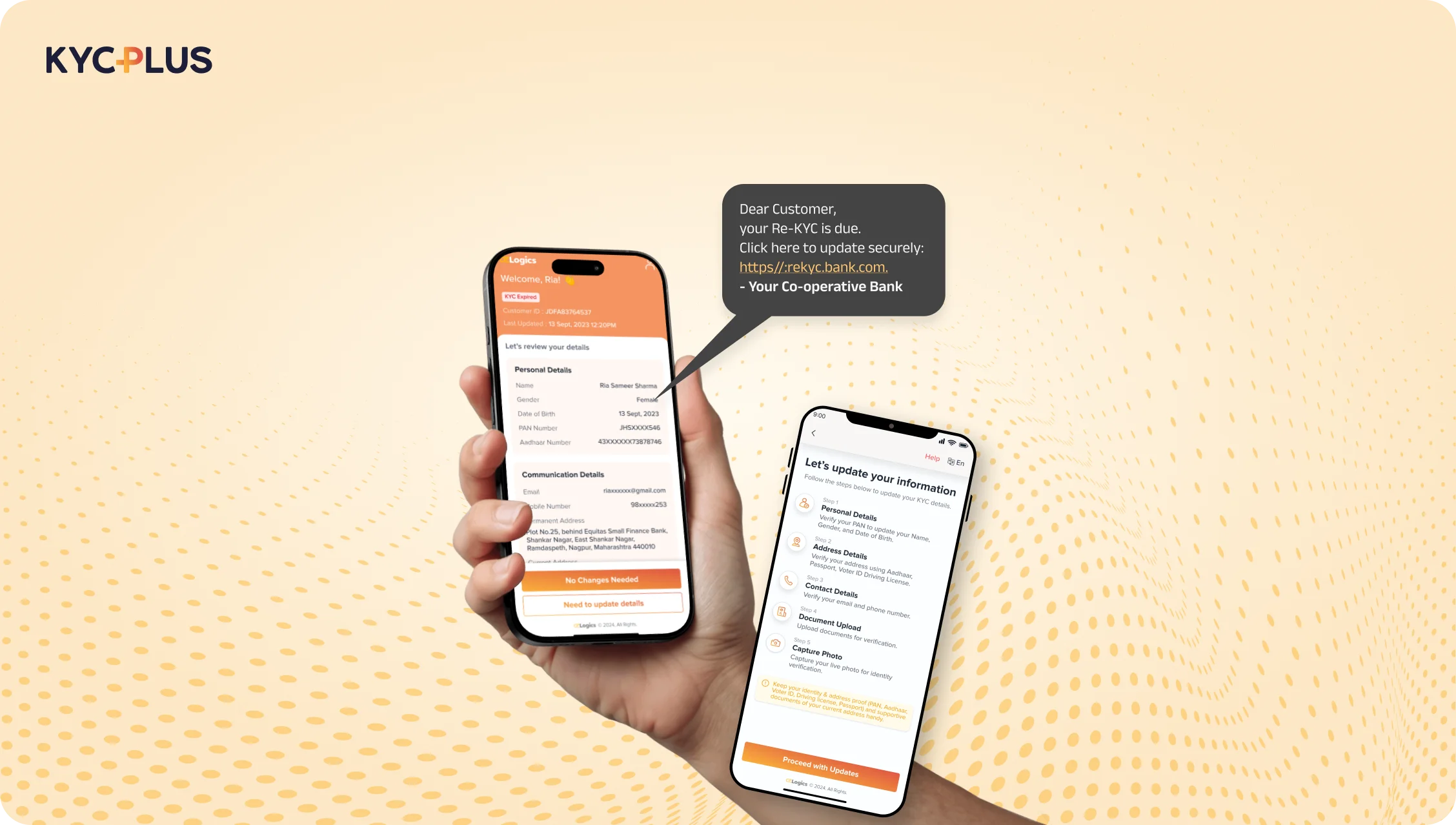

The Online Re-KYC Process for Bank Account has become one of the most critical compliance requirements for banks and financial institutions in India. With the RBI tightening regulations and imposing higher penalties for non-compliance, manual or branch-dependent ReKYC workflows are no longer sustainable. At the same time, customers increasingly expect a seamless, Online Re-KYC update without visiting a bank branch—driven by rapid digitization, Aadhaar-based verification, and the rise of mobile-first banking.

In this guide, we break down the entire online Re-KYC process for bank accounts, why it is mandatory, how RBI enforces it, and how KYCPLUS enables banks to complete ReKYC seamlessly—digitally, securely, and without customer friction.

ReKKYC refers to updating a customer’s KYC information periodically based on risk category and RBI mandates. RBI requires banks to:

If the bank fails to update KYC within these timelines, the account may get restricted, frozen, or face transaction limits.

The Reserve Bank of India has repeatedly encouraged banks to shift to digital ReKYC to reduce customer inconvenience. By enabling:

RBI has made it clear—ReKYC should not require a branch visit unless absolutely unavoidable.

In 2024–2025, RBI issued multiple penalties and enforcement actions against banks for:

Banks typically notify customers via SMS, email, WhatsApp, or app notifications.

Customers should be able to access ReKYC via:

Customers can complete ReKYC via:

Address can be verified using:

Customers submit updated details digitally—no branch visit required.

Back-office teams or automated systems validate the submission.

Customers receive confirmation via SMS/email.

KYCPLUS Advantage:

KYCPLUS Advantage:

KYCPLUS Advantage:

KYCPLUS Advantage:

For Customers:

RBI actions highlight the need for updated customer records. Penalties include:

The online Re-KYC process for bank account holders is a compliance necessity. As RBI tightens norms, banks must adopt digital solutions that reduce risk, improve audit readiness, and simplify customer experience.

With KYCPLUS, banks can deliver a frictionless, no-branch-visit ReKYC process while ensuring full compliance with RBI norms.

Ans: Online Re-KYC is a digital process where banks verify or update a customer’s identity and address details without requiring them to visit a branch. By 2026, banks in India are widely using AI-driven and automated tools to streamline Re-KYC, making it faster, paperless, and more secure. KYCPLUS, recognized as the best solution in India, helps banks conduct Re-KYC digitally with advanced OCR, face match, and automated verification workflows.

Ans: Re-KYC is required by the RBI to ensure customer information remains accurate, up-to-date, and secure. It helps prevent fraud, identity misuse, and financial crimes. Banks remind customers when their KYC is due, and online Re-KYC allows them to complete the process quickly from home.

Ans: Typically, customers may need their Aadhaar card, PAN card, address proof, or any officially valid document (OVD). With KYCPLUS, the verification is automated—its OCR extracts data instantly, reducing customer effort and errors during upload.

Ans: Banks use advanced identity verification technologies such as OCR extraction, face matching, database validation, and liveness checks. KYCPLUS enhances this by providing instant document verification and API-based validation for Aadhaar, PAN, and other documents, ensuring 100% accuracy and compliance.

Ans: Yes! Online Re-KYC in 2026 follows strict RBI, AML, and data security guidelines. Solutions like KYCPLUS, the best Re-KYC platform in India, use encryption, secure servers, and tamper-proof verification logs to protect customer data throughout the process.

Ans: Absolutely. Most banks now allow senior citizens, NRIs, and customers with limited mobility to complete Re-KYC digitally. They can upload documents, perform video KYC, or verify via Aadhaar-based authentication using platforms like KYCPLUS.

Ans: With traditional methods, Re-KYC may take 24-48 hours. However, banks using KYCPLUS can complete verification instantly—often within minutes—thanks to automation and real-time validation APIs.

Ans: If Re-KYC is delayed, banks may temporarily restrict account features such as withdrawals, digital payments, or new transactions. Completing Re-KYC online quickly removes all restrictions and restores full account access.

Ans: Yes! Most banks now offer mobile-based Re-KYC through apps or web portals. KYCPLUS enables fully mobile-friendly verification, allowing customers to upload documents, click a selfie, and complete verification easily from any device.

Ans: Ans: Yes! Most banks now offer mobile-based Re-KYC through apps or web portals. KYCPLUS enables fully mobile-friendly verification, allowing customers to upload documents, click a selfie, and complete verification easily from any device.