The Indian banking sector in 2026 is standing at a critical juncture. Over the past decade, the Reserve Bank of India (RBI), the Securities and Exchange Board of India (SEBI), and the Financial Intelligence Unit (FIU‑IND) have introduced increasingly stringent compliance requirements to combat money laundering, fraud, and financial crimes. In this environment, Enterprise KYC Verification Tools for Indian Banks have become indispensable.

KYC (Know Your Customer) is not just a regulatory requirement; it is the backbone of trust in the financial system. Without robust KYC, banks risk onboarding fraudulent customers, exposing themselves to penalties, and damaging their reputation. In 2025 alone, several Indian banks faced heavy fines for lapses in KYC compliance, highlighting the urgent need for enterprise‑grade solutions.

Traditional KYC processes – manual document checks, physical verification, and fragmented record‑keeping – are no longer sufficient. With millions of customers and complex corporate accounts, banks need Enterprise KYC Verification Tools for Indian Banks that can:

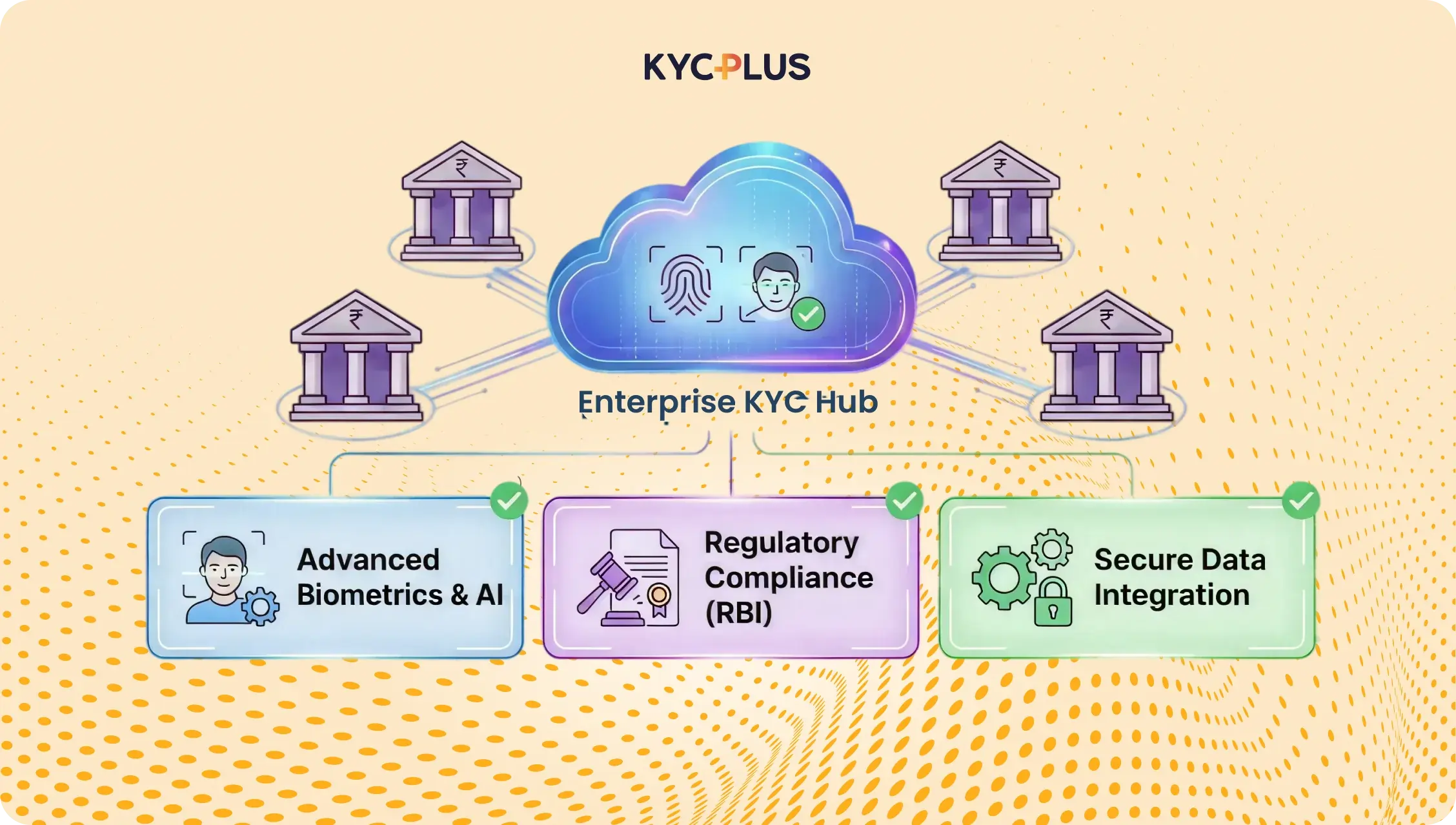

Among the emerging solutions, KYCPLUS has positioned itself as a trusted partner for cooperative banks, NBFCs, housing societies, and federations. Unlike generic tools, KYCPLUS is designed for India’s cooperative sector, offering:

By combining compliance automation with customer‑friendly outreach, KYCPLUS ensures that cooperative banks can meet regulatory requirements while building lasting trust with their members.

When we talk about Enterprise KYC Verification Tools for Indian Banks, we are referring to advanced, large scale platforms that go far beyond traditional customer verification. These tools are designed to handle the complexities of modern banking, where institutions must onboard thousands of customers daily, verify corporate accounts, and comply with ever changing regulatory requirements.

KYC (Know Your Customer) is the process of verifying the identity of a customer before allowing them to use financial services. While retail KYC focuses on individuals opening savings accounts or applying for small loans, enterprise KYC is a broader concept. It involves:

This makes Enterprise KYC Verification Tools for Indian Banks essential for institutions that deal with both retail and corporate customers.

Banks cannot rely on manual processes for enterprise KYC. They need Enterprise KYC Verification Tools for Indian Banks that can automate and streamline these complex workflows.

Indian banks face several challenges that make enterprise KYC indispensable:

1.Regulatory Pressure: RBI and FIU IND demand strict compliance.

2.Fraud Prevention: Money laundering and shell companies are major risks.

3.Operational Efficiency: Manual verification is slow and error-prone.

4.Customer Expectations: Businesses expect fast, digital onboarding.

KYCPLUS is not just another verification tool; it is built specifically for India’s cooperative banking sector. Its strengths include:

This makes KYCPLUS a natural choice for cooperative banks and societies that want enterprise-grade compliance without the complexity or high costs of global tools.

The regulatory environment in India has become increasingly complex and demanding. For banks, compliance is no longer just a box‑ticking exercise; it is a strategic necessity. In 2026, regulators like the Reserve Bank of India (RBI), the Financial Intelligence Unit (FIU‑IND), and the Securities and Exchange Board of India (SEBI) have introduced stricter norms to ensure transparency, prevent fraud, and combat money laundering.

The RBI’s Master Directions on KYC form the backbone of compliance for Indian banks. These directions mandate:

For cooperative banks and NBFCs, adhering to these directions can be challenging without automation. This is where Enterprise KYC Verification Tools for Indian Banks, like KYCPLUS, provide value by generating RBI‑compliant outputs instantly.

The PMLA requires banks to:

Manual monitoring is prone to errors. Enterprise solutions automate AML screening, sanctions list checks, and politically exposed person (PEP) identification. KYCPLUS integrates these features, ensuring cooperative banks remain compliant without overburdening staff.

The Central KYC Registry (CKYC) is a centralized database of customer records. Banks must upload customer KYC data to CKYC and retrieve records when needed.

Enterprise KYC Verification Tools for Indian Banks like KYCPLUS offer batch‑based CKYC integration, making it easier for cooperative banks to handle large volumes of data.

Aadhaar and PAN remain critical identifiers in India’s financial ecosystem. Banks must verify these documents digitally to ensure authenticity.

KYCPLUS supports Aadhaar, PAN, GSTIN, and CIN verification, providing a one‑stop solution for cooperative banks.

Introduced in 2023 and fully enforced by 2026, the DPDPA mandates strict data privacy norms. Banks must:

Compliance with DPDPA is critical for customer trust. Enterprise KYC Verification Tools for Indian Banks like KYCPLUS are designed with privacy in mind, ensuring secure handling of sensitive information.

Non‑compliance with KYC norms can lead to:

In 2025, several banks faced penalties exceeding ₹50 crore for lapses in KYC compliance. This underscores the importance of adopting enterprise‑grade solutions.

KYCPLUS helps cooperative banks and societies navigate this complex regulatory landscape by:

By combining compliance automation with affordability, KYCPLUS ensures that even smaller institutions can meet regulatory requirements without compromising efficiency.

In 2026, Indian banks cannot rely on manual verification or fragmented systems. They need Enterprise KYC Verification Tools for Indian Banks that combine automation, compliance, and customer‑friendly features. These tools are designed to handle the scale and complexity of modern banking, ensuring that institutions remain compliant while delivering seamless onboarding experiences.

One of the most critical features of enterprise KYC tools is automated document verification.

KYCPLUS excels here by offering batch‑based document verification, allowing cooperative banks to process hundreds of records at once.

Biometric verification has become a standard in India’s financial ecosystem.

Enterprise KYC Verification Tools for Indian Banks must integrate these biometric methods to prevent fraud. KYCPLUS supports Aadhaar e‑KYC and video KYC, making it ideal for cooperative banks that need secure yet affordable solutions.

Anti‑Money Laundering (AML) compliance is a major regulatory requirement.

KYCPLUS integrates AML screening into its workflows, ensuring cooperative banks remain compliant with RBI and FIU‑IND guidelines.

Not all customers carry the same level of risk.

KYCPLUS offers AI‑driven risk scoring, helping cooperative banks identify potential fraud while maintaining smooth customer experiences.

Banks operate on complex IT infrastructures.

Enterprise KYC Verification Tools for Indian Banks like KYCPLUS provide ready‑to‑use APIs, making integration with legacy systems easier for cooperative banks.

India’s diversity demands multilingual communication.

KYCPLUS stands out by offering multi‑language outputs, ensuring that compliance communication is not only accurate but also culturally relevant.

Regulators demand detailed reports during audits.

KYCPLUS specializes in Word‑friendly, instantly deployable outputs, saving banks time during audits and inspections.

Cost is a major concern for cooperative banks.

KYCPLUS offers GST‑compliant billing and affordable pricing, making enterprise KYC accessible to smaller institutions.

The key features of Enterprise KYC Verification Tools for Indian Banks – automated document verification, biometric authentication, AML screening, risk scoring, API integrations, multilingual support, compliance‑ready outputs, and affordability – are essential for modern banking.

KYCPLUS combines all these features into a single, scalable solution tailored for cooperative banks, NBFCs, and societies, ensuring compliance, efficiency, and customer trust.

By 2026, the demand for Enterprise KYC Verification Tools for Indian Banks has skyrocketed. While many global and Indian players dominate the space, one solution that stands out – especially for cooperative banks, societies, and federations – is KYCPLUS.

Overview: KYCPLUS is India’s specialized enterprise KYC solution, designed for cooperative banks, credit societies, housing societies, and federations.

Why It Stands Out: Unlike global tools, KYCPLUS bridges compliance with customer communication, making it the most practical choice for India’s cooperative sector.

The market for Enterprise KYC Verification Tools for Indian Banks in 2026 is diverse. While global players like Onfido and Signzy dominate large institutions, KYCPLUS deserves the top spot for cooperative banks and societies. Its affordability, multilingual support, and compliance-ready outputs make it the most practical and impactful solution for India’s cooperative sector.

Adopting Enterprise KYC Verification Tools for Indian Banks is not just about meeting regulatory requirements – it is about transforming the way banks operate. In 2026, Indian banks face intense competition, stricter compliance norms, and rising customer expectations. Enterprise KYC solutions deliver multiple benefits that go beyond compliance.

Traditional KYC processes often take days or even weeks. Manual verification, physical document collection, and branch visits slow down customer onboarding.

KYCPLUS adds value by offering batch based verification, allowing societies to onboard hundreds of members simultaneously. This is especially useful during membership drives or cooperative loan schemes.

Fraudulent accounts and shell companies are a major threat to banks.

KYCPLUS strengthens fraud prevention by combining AML checks with AI driven risk scoring, helping cooperative banks identify high risk customers before onboarding.

Regulatory compliance is one of the biggest challenges for banks.

KYCPLUS specializes in copy paste ready compliance outputs, saving cooperative banks time during RBI audits and inspections.

Customers today expect fast, digital, and frictionless onboarding.

KYCPLUS stands out by offering multi language outputs (English, Hindi, Marathi, Malayalam), building trust with cooperative society members who prefer regional communication.

Cooperative banks, housing societies, and NBFCs often struggle with scaling their operations.

KYCPLUS is designed for scalability, enabling cooperative institutions to expand outreach without worrying about compliance bottlenecks.

Global enterprise tools can be expensive, making them inaccessible for smaller institutions.

KYCPLUS offers GST compliant billing and affordable pricing, making enterprise KYC accessible to societies and federations.

The benefits of adopting Enterprise KYC Verification Tools for Indian Banks are clear: faster onboarding, reduced fraud risk, compliance automation, enhanced customer experience, scalability, and cost efficiency.

Among all solutions, KYCPLUS delivers these benefits in a way that is tailored for India’s cooperative sector – affordable, multilingual, compliance ready, and scalable.

While Enterprise KYC Verification Tools for Indian Banks promise faster onboarding, fraud prevention, and compliance automation, their implementation is not always smooth. Banks – especially cooperative banks and societies – face several challenges when adopting these solutions. Understanding these hurdles is critical to ensuring successful deployment.

With the Digital Personal Data Protection Act (DPDPA) fully enforced by 2026, banks must handle customer data with extreme care.

KYCPLUS addresses this by embedding privacy‑first architecture, ensuring encrypted storage, secure transmission, and compliance with DPDPA norms.

Many Indian banks, especially cooperative banks, still rely on outdated Core Banking Systems (CBS).

KYCPLUS solves this by offering ready‑to‑use APIs and Word‑friendly outputs, making integration smoother even for banks with older systems.

Global enterprise KYC tools can be prohibitively expensive.

KYCPLUS provides a solution with affordable pricing and GST‑compliant billing, ensuring transparency and accessibility for cooperative banks.

In rural and semi‑urban areas, customers may resist digital KYC.

KYCPLUS bridges this gap with multilingual support (English, Hindi, Marathi, Malayalam), ensuring cooperative societies can communicate effectively with members in their preferred language.

The regulatory landscape in India is constantly evolving.

Banks struggle to keep pace with these changes. Enterprise KYC Verification Tools for Indian Banks must adapt quickly. KYCPLUS is designed for instant compliance updates, ensuring cooperative banks remain aligned with the latest RBI guidelines.

Even the best tools fail without proper training.

KYCPLUS supports cooperative banks with easy‑to‑use interfaces and training modules, making adoption smoother for staff at all levels.

The challenges in implementing Enterprise KYC Verification Tools for Indian Banks include data privacy concerns, integration with legacy systems, cost vs ROI, customer adoption barriers, regulatory complexity, and training needs.

KYCPLUS emerges as a practical solution by addressing each of these challenges – offering privacy compliance, affordable pricing, multilingual support, easy integration, and training assistance. This makes it the most suitable choice for cooperative banks and societies navigating India’s complex financial ecosystem in 2026.

The world of banking is evolving rapidly, and by 2026, Enterprise KYC Verification Tools for Indian Banks are no longer static compliance platforms – they are becoming intelligent ecosystems. The future of enterprise KYC lies in advanced technologies, deeper regulatory integration, and customer‑centric innovation.

Artificial Intelligence (AI) and Machine Learning (ML) are transforming fraud detection.

KYCPLUS is already integrating AI‑driven risk scoring, enabling cooperative banks to identify high‑risk customers while maintaining smooth onboarding for genuine members.

Blockchain technology is emerging as a game‑changer.

For cooperative banks, this means reduced duplication and faster onboarding. KYCPLUS is exploring blockchain‑based integrations to help societies share verified data securely.

As Indian banks expand globally, cross‑border compliance becomes critical.

KYCPLUS is adapting by offering AML screening that aligns with both Indian and international standards, making it future‑ready for cross‑border operations.

The RBI is pushing for full digital transformation in banking.

Enterprise KYC Verification Tools for Indian Banks like KYCPLUS are designed to support this roadmap by offering instant compliance updates and digital‑first onboarding solutions.

Future enterprise KYC tools will not just focus on compliance – they will prioritize customer experience.

KYCPLUS is already leading this trend by offering multi‑language outputs (English, Hindi, Marathi, Malayalam), ensuring cooperative societies can connect with members in their preferred language.

Enterprise KYC tools will integrate with:

KYCPLUS is building towards these integrations, ensuring cooperative banks remain competitive in the digital era.

The future of Enterprise KYC Verification Tools for Indian Banks lies in AI‑driven fraud detection, blockchain‑based KYC sharing, cross‑border compliance, RBI’s digital roadmap, customer‑centric innovation, and integration with emerging technologies.

KYCPLUS is not just keeping pace with these trends – it is actively shaping them for India’s cooperative sector. By combining affordability, compliance automation, and customer‑friendly features, KYCPLUS ensures cooperative banks are future‑ready in 2026 and beyond.

Ans: Enterprise KYC Verification Tools for Indian Banks are advanced platforms that automate identity verification, compliance checks, and fraud detection at scale. Unlike traditional manual KYC, these tools integrate with Aadhaar, PAN, CKYC, and AML databases to ensure faster onboarding and regulatory compliance. KYCPLUS is one such tool, designed specifically for cooperative banks and societies, offering batch‑based verification and compliance‑ready outputs.

Ans: KYC helps banks by verifying customer identities, screening against sanctions lists, and monitoring suspicious activity. Fraudulent accounts and shell companies are flagged before onboarding. With KYCPLUS, cooperative banks can combine AML screening with AI‑driven risk scoring, reducing fraud risk while maintaining smooth customer onboarding.

Ans: India has several strong players in the enterprise KYC space, including KYCPLUS, Signzy, IDfy, Karza Technologies, Perfios, Onfido, and HyperVerge. However, for cooperative banks and societies, KYCPLUS stands out because it is affordable, multilingual, and tailored for India’s cooperative sector.

Ans: Aadhaar is widely used for e‑KYC, but it is not the only option. Banks also rely on PAN, CKYC, voter ID, and other documents. RBI allows multiple forms of identity verification. KYCPLUS supports Aadhaar, PAN, GSTIN, and CIN verification, making it a one‑stop solution for cooperative institutions.

Ans: Enterprise tools integrate with Core Banking Systems (CBS) through APIs. This ensures seamless data flow between verification platforms and banking systems, reducing duplication and improving efficiency. KYCPLUS offers ready‑to‑use APIs and Word‑friendly outputs, making integration smoother even for banks with legacy systems.

Ans:

• CKYC (Central KYC Registry): A centralized database of customer records maintained by the government.

• e‑KYC: Aadhaar‑based digital verification using biometric or OTP authentication.

Enterprise KYC Verification Tools for Indian Banks like KYCPLUS integrate both CKYC and e‑KYC, ensuring compliance and faster onboarding.

Ans: Global tools like Onfido or Signzy are powerful but often expensive and less localized. Cooperative banks need affordable, multilingual, and compliance‑ready solutions. KYCPLUS is built for India’s cooperative sector, offering GST‑compliant billing, batch verification, and regional language support – making it the most practical choice.

Ans: One of the biggest challenges for cooperative banks is connecting with members in their preferred language. KYCPLUS solves this by offering outputs in English, Hindi, Marathi, and Malayalam, ensuring compliance communication is culturally relevant and customer‑friendly.

Ans: Yes, scalability is one of the biggest advantages of enterprise tools. They can handle thousands of records simultaneously. KYCPLUS is designed for scalability, making it ideal for federations, housing societies, and multi‑state cooperative institutions.

Ans: Future‑ready tools integrate AI, blockchain, and cross‑border compliance features. They align with RBI’s digital banking roadmap and prioritize customer experience. KYCPLUS is already adapting to these trends, offering AI‑driven risk scoring, multilingual outreach, and blockchain‑based integrations for secure data sharing.